Purchasing your first home is an exciting milestone—filled with dreams of stability, comfort, and the chance to make a space truly your own. However, it’s also a process that can feel daunting, especially if you’re navigating it for the first time. With the ever-evolving real estate landscape and a variety of home-buying options at your fingertips, being informed is key to confidently moving forward.

For new buyers exploring Southern Indiana and Eastern Illinois, the opportunity to build or purchase a brand-new home adds an additional layer of flexibility and personalization to the process. From understanding critical decisions to preparing financially and selecting the right home, this guide offers practical tips to help you make informed choices.

With the right preparation and partnerships—like working with an experienced builder—your dream of homeownership can become an exciting reality.

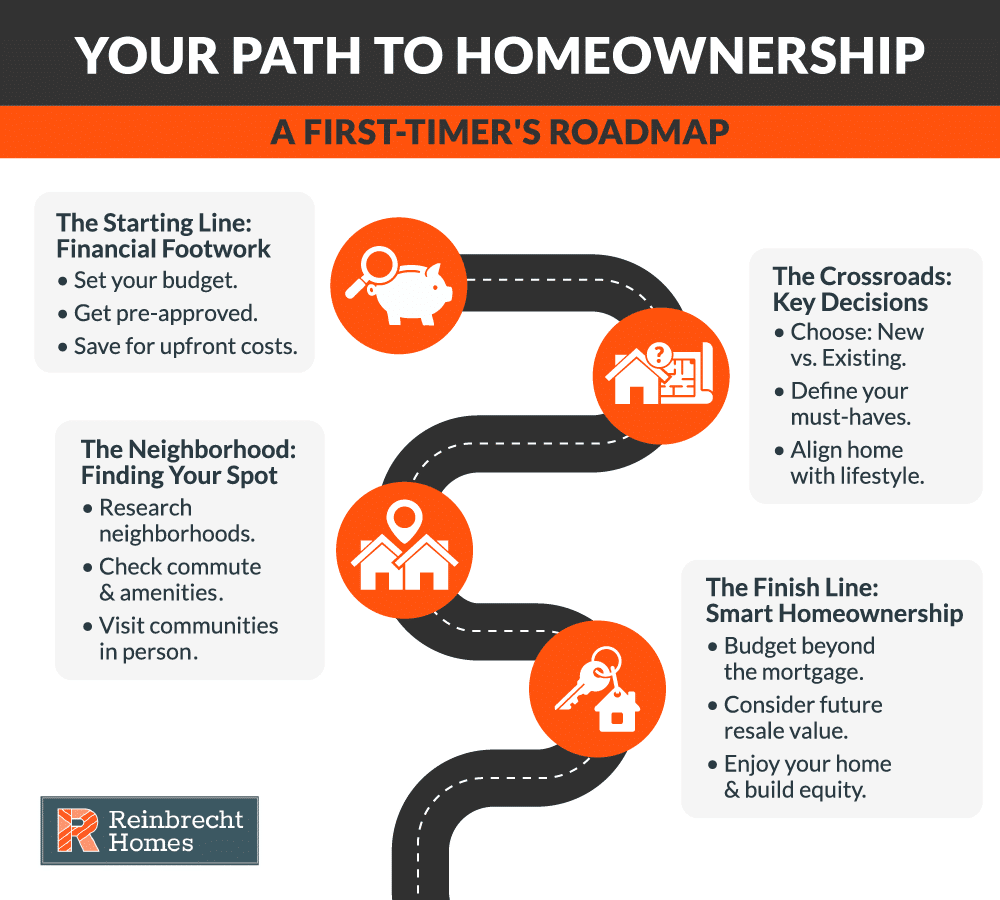

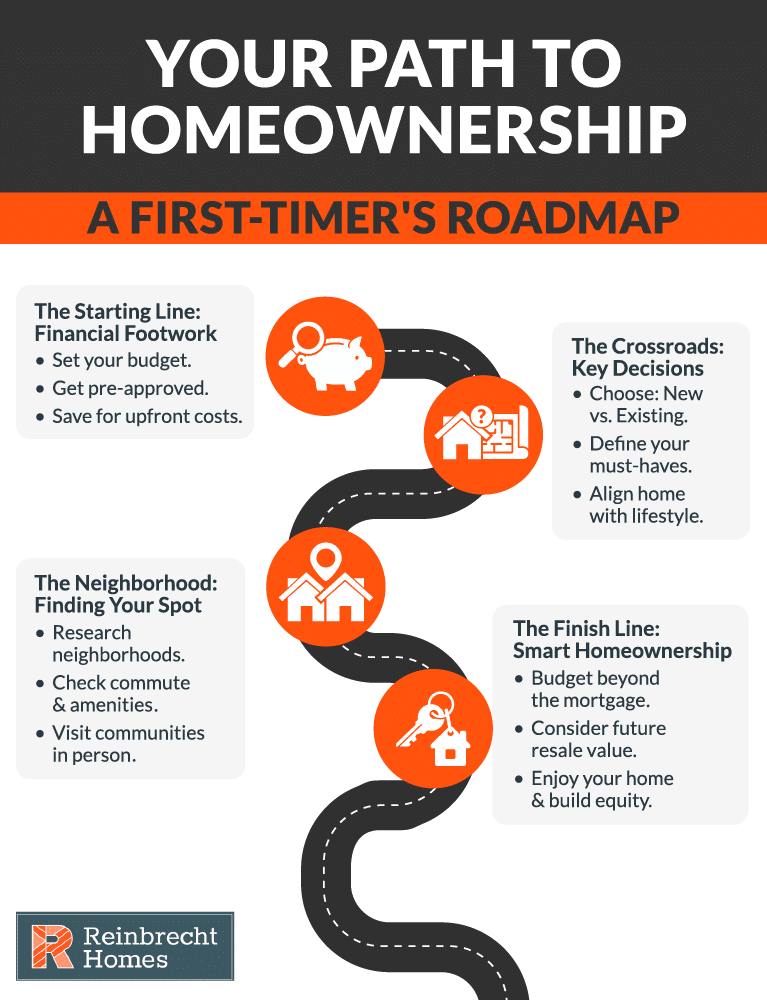

Understanding Key Decisions for First-Time Home Buyers

As a prospective homeowner venturing into the market, clarity in your decision-making process is essential to ensure your journey is both seamless and rewarding. From deciding whether to buy or rent to choosing between existing homes or new construction, understanding your options lays the foundation for a confident move toward homeownership.

Renting vs. Buying

The age-old question of whether to continue renting or take the plunge into homeownership requires careful thought. Renting often offers flexibility and lower upfront costs, but it lacks the long-term financial benefits of buying, such as building equity and gaining tax advantages. If you plan to stay in a specific area for several years, have a steady income, and are ready to settle into a more permanent living situation, buying a home can be the more rewarding choice.

Market conditions can vary widely across different regions. Some areas benefit from increased inventory and modest reductions in mortgage rates, while others still face challenges due to relatively high interest rates. It is important to weigh the long-term financial benefits of owning a home against the short-term conveniences of renting while considering your lifestyle, job stability, and personal goals.

Existing Homes vs. New Construction

Another important decision is selecting between purchasing an existing home or opting for new construction. Existing homes can seem like the simpler route, often allowing for a faster move-in timeline. However, they can also come with hidden costs, such as repairs, renovations, or outdated features.

By contrast, new construction provides a clean slate. Newly built homes often include modern features, energy-efficient systems, and layouts designed for today’s lifestyles. As a first-time buyer, the ability to personalize your space is incredibly appealing. Semi-custom homes offer structured flexibility, allowing you to adapt pre-designed plans to suit your needs. On the other hand, custom homes give you complete creative freedom but may come with slightly longer timelines and more decisions to make.

Both options have unique advantages, so prioritize your needs, timeline, and desired level of personalization to determine which path aligns best with your vision for your first home.

Preparing Your Finances

Financial preparation is one of the most critical steps in your journey to homeownership. By understanding your budget, exploring financing options, and planning for all associated costs, you can set yourself up for a stress-free experience. A strong financial foundation ensures that you can transition into your new home with confidence and peace of mind.

Defining a Realistic Budget

The first step in preparing financially is determining how much home you can comfortably afford. Your budget should encompass more than just the cost of the home—you’ll need to account for property taxes, homeowners insurance, and potential homeowners association (HOA) fees if applicable. Start by reviewing your current monthly expenses, such as student loans, car payments, utilities, and entertainment. Then, calculate how much remains for a potential housing expense.

A good rule of thumb is to keep your total monthly housing costs within a comfortable range of your income. Online tools like Reinbrecht Homes’ mortgage calculator can help you estimate monthly payments based on factors like interest rates and loan amounts. These insights provide valuable direction before you begin viewing homes or meeting with lenders.

Exploring Loan Options

Understanding your financing options is another vital step in the process. For first-time buyers, there are several mortgage products available, including conventional loans and government-backed options such as those from the Federal Housing Administration (FHA). Each loan type has unique benefits: conventional loans may require a larger down payment but often come with more competitive interest rates, while FHA loans are typically more accessible for buyers with smaller down payments or lower credit scores.

Looking at resources offered by organizations such as Indiana Housing & Community Development Authority (IHCDA) or the Illinois Housing Development Authority (IHDA) can help you discover first-time buyer programs that may provide down payment assistance or other incentives. Additionally, some builders offer financing incentives—such as credits toward closing costs or preferential construction loan terms—to make financing more accessible for those considering custom or semi-custom homes. Comparing different loan types and seeking pre-approval from lenders can offer clarity on the resources available to you.

Planning Beyond the Down Payment

For many first-time buyers, saving for a down payment is the most obvious financial goal, but it’s important to prepare for additional costs as well. According to a Bankrate article, closing costs can account for 2% to 5% of the home’s purchase price and may include lender fees, title insurance, and appraisals. In addition, local property taxes can impact your monthly budget.

Once you’re settled into your new home, ongoing costs like regular maintenance and repairs will become part of your financial picture. Setting aside an emergency fund—equivalent to a few months’ worth of mortgage payments—provides a valuable buffer against unexpected expenses. By thoughtfully assessing your budget, researching your financing options, and preparing for both planned and unplanned costs, you’ll be in a strong position to embark confidently on your journey as a first-time home buyer.

Choosing the Right Home

Choosing your first home is more than just finding a place to live—it’s about identifying a space where you can create lasting memories, accommodate your lifestyle, and plan for the future. This step in the home-buying journey requires thoughtful consideration of your priorities, preferences, and long-term goals.

Defining Your Must-Haves

Begin by outlining the key features your ideal home should have. Think about the number of bedrooms and bathrooms you need, the layout that best suits your lifestyle, and any additional spaces—like a home office or a playroom for a growing family. Outdoor areas, such as a backyard for pets or entertaining, may also be important. Beyond the interior, consider practical details such as commute times, proximity to schools, or access to local amenities.

By clarifying your “must-haves” early, you reduce the risk of compromising on essentials while ensuring you focus your search on homes that meet your needs. This approach allows you to balance practical requirements with personal preferences and avoid falling in love with homes that don’t align with your lifestyle.

Exploring Neighborhoods in Southern Indiana and Eastern Illinois

The community you live in is just as important as the home itself. Southern Indiana and Eastern Illinois boast vibrant neighborhoods that offer ample amenities—such as parks, green spaces, and easy access to shopping and dining. Tools like Zillow’s real estate data or Trulia’s comprehensive search tools can help you scope out market trends, neighborhood demographics, and local hot spots.

Take the time to experience different communities by driving through them, walking around, and evaluating the atmosphere. Observe noise levels, traffic, and the overall sense of safety. Consider how the location fits into your everyday life. Is the commute manageable? Do the nearby amenities match your current and future needs? By focusing on areas that align with your lifestyle, you can set yourself up for a more fulfilling and enjoyable homeownership experience.

Aligning Floor Plans With Your Lifestyle

A home’s floor plan plays a significant role in how well it supports your daily routine, so it’s essential to choose one that fits your lifestyle. Open-concept layouts, for example, are perfect for those who enjoy hosting friends and family, while traditional or segmented layouts may offer better privacy and organization.

When working with a builder, you have the advantage of exploring semi-custom floor plans, which allow for modifications that align with your needs. For instance, you may opt for a larger kitchen, a dedicated office, or additional storage. Custom homes, on the other hand, provide the ultimate flexibility for designing a space around your specific requirements and preferences.

While customizations allow for personalization, they often require more decisions and time. Finding a balance between personalization and practicality will ensure your new home provides the comfort, functionality, and longevity you envision.

Navigating the Home Construction Process

Building your first home is an exciting opportunity to create a space perfectly tailored to your needs. However, it’s important to approach the construction process with the right tools, guidance, and mindset. From choosing a reliable builder to monitoring progress and ensuring quality, there are several key steps to keep your project on track and stress-free.

Choosing a Reliable Home Builder

Selecting the right builder is the cornerstone of a successful home construction experience. Look for a builder with extensive experience, a strong reputation, and a commitment to transparency. A reliable team will provide clear timelines, detailed cost estimates, and open communication throughout the process. Checking builder ratings and reviews from the Better Business Bureau (BBB) can offer additional insights.

Beyond credentials, consider the builder’s approach to customer service. Do they listen to your needs and preferences? Are they proactive in offering solutions or guidance? Partnering with a trusted local builder who values collaboration and prioritizes customer satisfaction can make all the difference. Their experience with the specific needs of first-time buyers in Southern Indiana and Eastern Illinois is an invaluable asset.

Staying Informed and Involved

Being actively involved in your home’s construction helps you stay connected to the progress and ensures everything is moving according to plan. Many builders now offer digital project-management platforms. One such tool is Buildertrend, a system that provides real-time construction updates, scheduling details, and budget tracking. This high level of transparency not only reduces stress but allows for timely decisions on any design elements or finishes.

Verifying Quality at Every Stage

An essential part of the construction process is ensuring that quality standards are met at each phase, from the foundation to the finishing touches. Walk-through inspections at key milestones—such as framing, electrical installation, and final detailing—give you the chance to evaluate progress and address any concerns early.

With an experienced team, you can rely on professional expertise to ensure top-notch craftsmanship and the use of durable materials. Builders often invite buyers to participate in these inspections, creating opportunities to ask questions and confirm that the project aligns with your vision. A final inspection before move-in further confirms your home meets all safety codes and standards, offering peace of mind as you prepare to move in.

Maximizing the Benefits of Collaboration

Open communication with your builder is key to a smooth and successful experience. Share your priorities, provide feedback, and ask for clarification whenever needed. This collaborative environment can mitigate potential challenges and keep the project running on schedule.

By choosing the right partner, staying informed, and prioritizing quality, you can navigate the home construction process with confidence. Whether you’re building a semi-custom or fully custom home, the experience of designing and seeing your vision come to life is truly rewarding.

Avoiding Common First-Time Mistakes

As a first-time home buyer, it’s easy to get caught up in the excitement and overlook potential pitfalls. By being aware of common missteps and taking a proactive approach, you can ensure a smoother path to long-term satisfaction and financial stability.

Overlooking the True Cost of Homeownership

While the monthly mortgage payment is often top of mind, the total cost of owning a home extends beyond it. Costs such as utilities, property taxes, homeowners insurance, and routine maintenance are all parts of the equation. For new construction, building with energy efficiency in mind may help reduce utility bills, but budget for recurring upkeep—like lawn care, HVAC servicing, and unexpected repairs.

Planning for ongoing expenses and setting aside an emergency fund can guard against unforeseen challenges. This mindset not only keeps your finances intact but also preserves the joy of homeownership over the long run.

Rushing Without Thorough Research

Finding a potential dream home can spur excitement, but moving too quickly can lead to expensive regrets. Make it a priority to get pre-approved for a mortgage before beginning your search. Pre-approval not only clarifies your price range but also strengthens your position as a serious buyer.

When considering a particular builder or property, do your homework: review past projects, ask for customer testimonials, assess warranties, and consult reputable organizations like the U.S. Department of Housing and Urban Development (HUD) for general advice. Thorough research empowers you to enter the home-buying process with confidence and clarity.

Ignoring Long-Term Resale Value

While you may plan to live in your first home indefinitely, life is unpredictable. Keeping an eye on potential resale value is a wise strategy. Factors such as the home’s location, proximity to reputable schools, lot size, and overall property condition can significantly impact future marketability. Even if you don’t move for many years, a property with broad appeal retains its value and offers flexibility should your circumstances evolve.

By addressing these common mistakes—focusing on overall costs, doing thorough research, and keeping long-term resale in mind—you’ll avoid unnecessary headaches and build a strong foundation for a successful homeownership journey.

Advantages of Partnering With a Trusted Home Builder

Choosing the right home builder simplifies your journey to homeownership by providing expertise, transparency, and solutions tailored to first-time buyers. A key advantage is gaining a partner with deep experience, who can guide you through location-specific decisions and processes.

An experienced builder, like Reinbrecht Homes, can also provide significant financial guidance. They often have established relationships with lenders and can introduce you to financing incentives specifically for new construction, such as credits toward closing costs or favorable construction loan terms. This, combined with clear, upfront pricing, helps eliminate financial surprises and clarifies your total investment from the start.

Finally, a trusted builder ensures the quality of your new home. Beyond the inherent benefits of modern construction and energy efficiency, a reputable builder provides comprehensive homebuyer warranties for long-term peace of mind. By choosing an expert partner who prioritizes craftsmanship and client support, you build a strong foundation for your future as a homeowner.

Embarking on Your Homeownership Journey with Confidence

Becoming a homeowner for the first time is both exciting and meaningful—it gives you the chance to craft a space that truly mirrors your aspirations and way of life. Though the home-buying process might appear overwhelming, thorough planning, financial preparedness, and the support of experienced professionals will guide you toward success. While real estate forecasts can present both opportunities (like increased inventory in some markets) and challenges (higher interest rates in certain areas), staying informed is more important than ever.

If you’re ready to take the next step, explore your financing options, outline your must-have features, and align with an expert team to help bring your vision to life. Contact Reinbrecht Homes today to begin your journey toward a stress-free, personalized homebuilding experience. With determination, research, and the right support, you can make your first home purchase a memorable and fulfilling chapter in your life.