Building a new home in Evansville, IN, is a chance to create exactly what you want—location, layout, finishes, and long-term comfort. But before you start choosing floor plans or picking out fixtures, it’s essential to understand what it will actually cost to build in 2026. With material prices, labor rates, and interest rates all shifting over time, having a clear picture of potential expenses can help you avoid surprises and make confident decisions.

This guide breaks down the real-world costs of building a house in Evansville and the surrounding Southern Indiana communities, with a focus on what to expect in 2026. You’ll learn how key factors—like materials, labor, permits, land, and your level of customization—shape your total budget. We’ll also outline typical price ranges for semi-custom and fully custom homes, highlight often-overlooked expenses, and share practical cost-saving strategies. Finally, you’ll see how financing options can impact your overall bottom line, so you can move forward with a realistic plan and a builder who understands the local market.

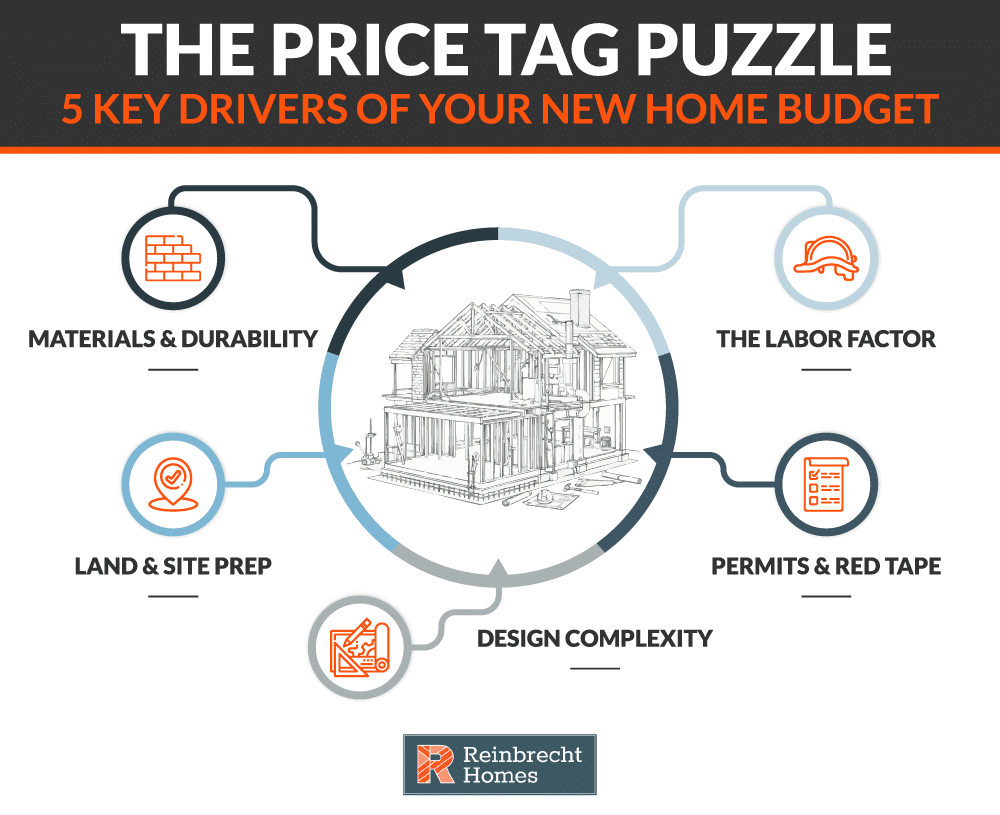

Breakdown of the Factors Influencing the Cost to Build a House

Your total building cost depends on several key factors. Carefully considering each element will help you make informed decisions.

Construction Materials

Material selection greatly influences your budget. High-quality options not only uplift the home’s appearance but also promise durability. Whether you choose luxury finishes or more budget-friendly alternatives, selecting the right construction materials can have a lasting impact. It’s important to weigh initial costs against long-term savings, especially when considering sustainable or energy-efficient materials. For example, energy-efficient windows might involve a higher upfront price tag but can reduce utility bills over the life of the home.

Labor Costs

Labor is a significant expense in home construction. The availability and skill level of tradespeople and general contractors can affect overall labor costs. In a growing market like Evansville, rising demand for new home construction may drive up labor expenses at peak times. Turning to an experienced local builder with well-established crews can help you minimize delays, adhere to quality standards, and keep labor-related expenditures manageable. A builder who has maintained strong networks over the years is often better able to schedule tasks seamlessly, preventing prolonged downtime that can inflate your budget.

Permits, Zoning, and Local Regulations

Adhering to building codes and zoning laws is mandatory. Permit fees in Evansville vary based on the build’s scope, with fees covering structural plan reviews, inspections, and city/county administrative processes. Identifying the right lot and thoroughly understanding local regulations before you begin can prevent costly redesigns or fines. Reputable local builders, including Reinbrecht Homes, are known for their expertise in managing local permitting processes and working efficiently with local authorities, which can help streamline approvals and reduce delays.

For more details on local building requirements, review guidelines from the Vanderburgh County Building Commission or consult the Indiana State Building Code Guidelines. Builders of this caliber often have extensive knowledge of local permitting procedures, which helps in expediting necessary approvals and avoiding setbacks.

Land Prices and Preparation Costs

Land prices in and around Evansville vary widely. Central locations usually carry higher price tags, whereas suburban or rural plots can be more affordable. Beyond the purchase price, you should anticipate expenses related to grading, excavation, and utility connections. A preliminary assessment of your lot—for soil quality, drainage, and other factors—helps prevent unpleasant surprises once construction begins. For instance, unexpected rock outcroppings or clay-like soil may influence foundation design and preparation expenses.

Customization and Design Options

Your choice between a semi-custom and a fully custom home will directly impact costs:

- A semi-custom home typically starts with a standard floor plan, which you personalize through various upgrades. These homes tend to be more budget-friendly and allow for meaningful design changes, like modifying cabinetry finishes or selecting upgraded fixtures, without significant re-engineering.

- A fully custom home, while offering complete creative control, can be significantly more expensive because each detail is tailored to your preferences. Balancing your vision with practical constraints—such as building codes and environmental considerations—is key to a successful outcome.

Estimated Cost Ranges for Building in Evansville, IN (2026)

While exact figures depend on your chosen design and features, the following estimates provide a general framework. These ranges can also fluctuate based on broader economic factors, such as a surge in demand for certain materials, changes in interest rates, or evolving market trends in Southern Indiana.

Semi-Custom Homes

- Starting Range: Mid-to-upper $200,000

- Upgraded Features: Can push costs into the mid-$300,000 range

Semi-custom options offer a balance of personalization and cost efficiency, making them a popular choice for many homebuyers. Common upgrades in this category might include higher-grade countertops, distinctive exterior finishes, or advanced kitchen appliances.

Fully Custom Homes

Fully custom homes allow you to design every element, but the final budget depends on your unique requirements. High-end customizations—such as premium finishes, intricate millwork, smart home technology integrations, or significant square footage—can raise costs substantially beyond initial estimates. In many cases, fully custom builds in premium communities can extend well into the $400,000 to $500,000 range—or even higher—depending on the caliber of design and specialized craftsmanship involved.

New Construction vs. Existing Homes

Building new offers the chance to create a home that meets today’s energy standards, layout preferences, and design trends, often with fewer immediate maintenance issues. Purchasing an existing home rather than building may appear cheaper upfront, but renovating or addressing hidden problems—like outdated wiring or water damage—can narrow the cost difference over time. For families planning to stay in a home for many years, the long-term benefits of new construction can outweigh initial cost savings tied to an older property.

Post-Construction Expenses

Budget for these additional expenses:

- Landscaping: Basic outdoor design can range into the thousands, depending on whether you choose simple sod or a more elaborate landscape plan with trees, shrubs, and hardscaping.

- Furnishings and Appliances: Outfitting your home is a significant line item, particularly if you plan on investing in modern, high-quality appliances or custom furniture. Tools like Reinbrecht’s home purchasing guide can help you think through these longer-term costs.

- Routine Maintenance: Staying on top of regular maintenance, such as HVAC tune-ups or roof inspections, maximizes your home’s longevity.

- Utility Connection Fees: Check local guidelines to account for hooking up water, electricity, gas, and sewer lines. These fees can vary by neighborhood.

Hidden or Additional Costs to Consider

Even with meticulous planning, unforeseen events can affect your budget:

- Inspections and Appraisals: Multiple inspections or a detailed appraisal may be required for final financing.

- Weather-Related Delays: Unpredictable weather in Southern Indiana can slow the build process, adding extra days or weeks to schedules and increasing labor costs.

- Unforeseen Site Conditions: Issues like poor soil quality or hidden debris can quickly escalate costs.

- Contingency Fund: It’s wise to set aside at least 5% to 10% of your total budget for unexpected issues. These unexpected expenses might include design modifications midway through the project or last-minute improvements that prove beneficial once construction is underway.

Cost-Saving Strategies for Home Buyers

Smart, strategic choices can help you reduce expenses without compromising on quality:

- Prioritize Essential Features: Focus on layout and efficiency, then consider more affordable alternatives for optional extras. Investing in quality windows and insulation, for instance, can offer long-term benefits without ballooning your budget.

- Leverage Builder Experience: Experienced builders are familiar with cost-effective options that maintain quality. Builders who have navigated a range of budgets can often pinpoint where upgrades are most beneficial and where to moderate spending.

- Choose Transparent Pricing: Seek out companies that offer detailed, upfront cost breakdowns for accuracy and peace of mind.

- Understand Financing Options: Reinbrecht Homes stands out by offering free construction loans, which can reduce or eliminate certain upfront loan costs that other financing methods typically impose.

- Opt for Semi-Custom Designs: Balance personalization with a standard blueprint to manage overall expenses. Semi-custom homes can still incorporate select design touches, especially in kitchens, living areas, and master suites, without the higher cost of fully custom rebuilds.

- Plan for Long-Term Savings: Investing in durable materials or energy-efficient upgrades can reduce ongoing costs. Higher-grade insulation or solar-ready roofing could lead to lower utility bills and may even offer state or federal tax incentives.

- Consider Using Tools: A free online cost estimator can give you a ballpark figure as you refine your design choices.

Financing Your New Home Build in Evansville, IN

Securing the right financing is pivotal. The nature of your loan determines your financial obligations during construction and beyond. Some homeowners might rely on a blend of traditional mortgage and construction loans, whereas others prefer specialized builder-backed financing.

Common Financing Options

- Construction Loans: These loans fund the building phase, disbursing money as needed. They typically require periodic inspections and an interest-only payment structure until the project is complete.

- Traditional Mortgages: Useful if you already own land or as a next step once construction is complete, traditional mortgages consolidate your debt under a long-term payment plan.

- Unique Construction Financing: Some builders, including Reinbrecht Homes, offer creative financing solutions tailored to new home builds, ensuring you won’t face excessive interest charges or dual loans during construction.

Additionally, you can explore resources from the Indiana Housing & Community Development Authority to discover potential state programs or incentives that might help lower financing costs.

Spotlight on Free Construction Loans

A standout benefit with Reinbrecht Homes is their offering of free construction loans. Simply put, these loans can remove or drastically reduce standard construction-related loan fees that buyers often encounter. Instead of paying interest during the construction phase or dealing with multiple closing costs, you can streamline your financing. By eliminating extra layers of financing charges:

- Buyers don’t have to pay out-of-pocket interest fees while the home is still under construction.

- The overall project budget becomes more predictable.

- Borrowers can allocate more toward design finishes, upgraded materials, or additional square footage in their home.

Moreover, the free construction loan program often makes transitioning to a permanent mortgage simpler and more cost-effective once the home is completed. This exceptional financing approach underscores Reinbrecht Homes’ commitment to making the building process accessible and transparent.

Tips for Managing Loan Costs

- Shop Around: Get multiple quotes to secure competitive rates. Even with free construction loans, you’ll eventually need a permanent mortgage solution, so it pays to compare lenders.

- Check Your Credit Score: A higher score can mean lower interest rates on your mortgage loan. Improving your credit before construction begins might yield significant savings.

- Collaborate with Local Experts: Builders who partner with regional lenders may offer advantageous terms. Having both the lender and builder local to the area often expedites communication and reduces red tape.

Emerging Trends and the 2026 Market Outlook for Evansville Homes

Evansville’s real estate market continues to grow, influenced by evolving technologies and design preferences. Whether you’re drawn to the city’s established neighborhoods or newer developments on its outskirts, staying informed about market trajectories can help you make the right decisions.

- Smart home technologies are increasingly common, enhancing convenience and energy management. Features like integrated security systems and app-controlled lighting can potentially boost resale value.

- Sustainable materials are gaining favor among homeowners who want reduced environmental impact and better long-term cost savings. Using reclaimed woods or advanced insulation materials, for instance, can strike a balance between style and an eco-friendly footprint.

- Flexible floor plans are more popular than ever, accommodating changing lifestyles such as multi-generational living or work-from-home setups. If you plan to sell down the road, designing with flexibility in mind may attract a broader pool of future buyers who prioritize adaptable spaces.

Planning for the Future: Maintenance and Resale Value

Beyond upfront costs, it’s important to consider how your choices will affect long-term maintenance and resale potential:

Maintenance Considerations

- Durable Exterior Materials: Brick or fiber cement siding can significantly reduce the frequency of exterior repairs. Over a 10-year period, choosing a durable siding option might save thousands in repainting and touch-up costs.

- Quality Roofing Systems: A roof built with weather-resistant shingles or metal materials can withstand Southern Indiana’s varied climate, reducing the need for frequent replacements or repairs.

- Energy-Efficient Systems: Modern HVAC systems, proper insulation, and efficient water heaters help maintain a comfortable home while keeping utility bills manageable.

Resale Potential

- Modern Floor Plans: Open-concept designs continue to be a significant selling point, especially for growing families.

- Smart Home Installations: As technology advances, features like doorbell cameras, automated thermostats, and app-controlled security systems may bolster market value.

- Neighborhood Amenities: Building in a community with access to parks, walking trails, or strong local schools can increase your home’s desirability.

Keeping future buyers in mind even as you build can improve long-term returns on your investment. If you aim to stay in your new home indefinitely, you can still benefit from design choices that ensure hassle-free maintenance and adaptability.

Reinbrecht Homes: Your Trusted Partner for Building a Dream Home

Selecting a reputable builder ensures your new home stands the test of time. Reinbrecht Homes, founded in 1995, offers a combination of experience and customized service:

- Range of Options: From semi-custom to fully custom and move-in-ready homes. Whether you have a vision for a sprawling ranch-style layout or a modern two-story residence, Reinbrecht Homes can guide you through the possibilities.

- Detailed Cost Estimates: Seasoned builders can provide comprehensive, transparent pricing, making it easier for you to plan effectively.

- Quality Craftsmanship: The team prioritizes materials and building processes that ensure longevity. This includes everything from sturdy foundations to precise carpentry details.

- Local Expertise: Decades of experience in Southern Indiana markets mean familiarity with local permit regulations, neighborhood trends, and the best vendors in the region.

- Free Construction Loans: Reinbrecht Homes simplifies the financing journey by offering free construction loans, helping reduce or eliminate typical loan fees during the building phase.

Bringing Your 2026 Evansville Home Build into Focus

Building a house in Evansville, IN, in 2026 can be a fulfilling endeavor when you have a clear understanding of the costs involved. By considering factors like construction materials, labor expenses, and land preparation—along with financing options that might include construction loans or traditional mortgages—you’ll be better prepared for both the expected and unforeseen. Thoughtful planning, smart builder selection, and keeping a contingency fund can help you stay on budget and focus on creating the home you’ve always wanted.

Ready to take the next step? Schedule a consultation with Reinbrecht Homes and begin your journey toward turning your dream home into a reality.