Building your dream home can seem overwhelming, especially when it comes to financing. Still, using your land as collateral for a construction loan offers a practical way to help turn your vision into reality. By leveraging the value of your property, you might reduce some upfront costs and simplify the financing process. However, the extent to which you benefit—with lower down payments or smaller monthly repayments—will depend on factors such as your land’s equity, your financial situation, and specific lender policies.

In this guide, we break down the process, explain key requirements and potential benefits, and provide clear, actionable steps—all while showing how Reinbrecht Homes is ready to support your journey every step of the way.

What Is a Construction Loan?

A construction loan is a special type of short-term financing designed to cover the cost of building a home. Unlike a traditional mortgage that provides a lump sum for an existing home, construction loans are disbursed in smaller, scheduled payments aligned with the building stages. These scheduled payments, often called “draws,” are released as work on the home progresses—from site preparation and foundation work to final finishes.

Typically, construction loans last 12 to 18 months. After construction, borrowers can transition into a permanent mortgage, converting the short-term loan into long-term financing. This setup is ideal for custom and semi-custom projects because it accommodates unique building schedules and personalized budgets.

Types of Construction Loans

- One-Time Close Loan (Construction-to-Permanent): Combines construction and permanent financing into a single loan, reducing paperwork and closing costs—a convenient option for first-time homebuilders.

- Two-Time Close Loan: Involves a separate construction loan followed by a long-term mortgage. Although it requires two closings, it offers the flexibility to shop for the best mortgage terms after building.

- Renovation Loans: Designed for extensive remodeling or building projects on an existing home, these loans also release funds in stages and are useful for major upgrades.

Using your land as collateral can, in some cases, strengthen your financing by providing additional security. This extra security may help in reducing down payment requirements and improving the overall loan terms, though the exact benefits vary by circumstance.

How Land Collateral Works in the Construction Loan Process

When you use land as collateral, its value becomes security that backs your loan, which can potentially lead to more favorable financing arrangements. However, while some borrowers may experience reduced upfront costs and lower borrowing needs, these benefits are not guaranteed and depend on factors such as the appraisal values and lender requirements.

Assessing Your Land’s Value

Lenders require a professional appraisal to determine your land’s worth. An appraiser considers location, size, zoning, utility access, and recent sales of similar properties. The resulting valuation shows how much equity your land contributes toward the loan, which may reduce the amount you need to borrow.

Understanding Equity and Its Impact

Equity is the difference between your land’s appraised value and any loans or liens attached to it. Higher equity may help secure better financing terms, such as potentially lower interest rates or increased borrowing flexibility. However, the impact on your down payment requirements and monthly payments will depend on your lender’s specific policies and your overall financial profile.

The Importance of Appraisal

A fair appraisal is critical. It confirms that the property meets construction requirements—such as proper zoning and utility access—and ensures that the lender has a clear view of your asset’s value. This step not only supports your loan application but also sets realistic expectations for your project’s financing.

Requirements for Using Land as Collateral

Lenders set specific criteria to ensure that using land as collateral is a sound financial decision. Meeting these requirements can streamline your loan approval process.

Clear Documentation and Ownership

- Provide legal proof of land ownership, such as a title or deed.

- Resolve any outstanding liens or disputes beforehand to avoid delays.

Zoning and Land Readiness

- Ensure the property is zoned for residential use.

- Verify that the land is ready for construction with proper utility access and any necessary improvements completed.

Financial Stability and Construction Plans

- Maintain a strong credit history and a low debt-to-income ratio.

- Submit comprehensive construction plans that include blueprints, a builder’s contract, a detailed budget, and a project timeline. These documents reassure lenders that your project is both viable and well-planned.

Potential Benefits of Using Land as Collateral

Leveraging your land’s equity can offer several advantages, though the actual benefits will depend on your specific situation:

Potential for Reduced Borrowing Needs

Using your land’s equity can sometimes lower the total amount you need to finance. This might result in a reduced initial borrowing requirement and potentially lower down payments, but these benefits vary based on the land’s appraised value and lender evaluation.

Potential for a Streamlined Financing Process

Combining the value of your land with a construction loan can simplify the process by consolidating separate financing needs. This approach might also reduce overall paperwork and speed up loan approval, although results depend on individual lender procedures.

Possible Improvement in Loan Terms

Since a property-backed loan presents less risk to lenders, having land as collateral may lead to lower interest rates or more favorable repayment terms in some cases. However, actual outcomes will depend on factors like loan-to-value ratios, market conditions, and your financial stability.

Greater Flexibility for Customization

Using land equity gives you more financial freedom to focus on the features that matter most, potentially allowing you to build a home that suits your lifestyle and preferences.

Faster Approval and Project Kick-Off

A well-documented land asset might help facilitate quicker review and approval. Still, this is contingent on meeting all lender requirements and having a solid appraisal in hand.

Potential Challenges and Risks

While the potential benefits are significant, there are a few challenges to be aware of:

Construction Delays

Unexpected delays—caused by weather, material shortages, or labor issues—can affect the timing of draw payments and overall costs. It’s wise to plan for possible setbacks in your timeline and budget.

Appraisal Variability

A lower-than-expected appraisal can reduce the available equity, potentially increasing your required down payment. It’s important to ensure your land is well-prepared and accurately represented before appraisal.

Financial Defaults

Using land as collateral means that if you fail to meet your loan obligations, you risk losing both your land and your construction investment. Careful financial planning is essential to avoid defaulting.

Market Fluctuations

Changes in the real estate market can impact your land’s value over time. Understanding local market trends and having contingency plans in place can help mitigate this risk.

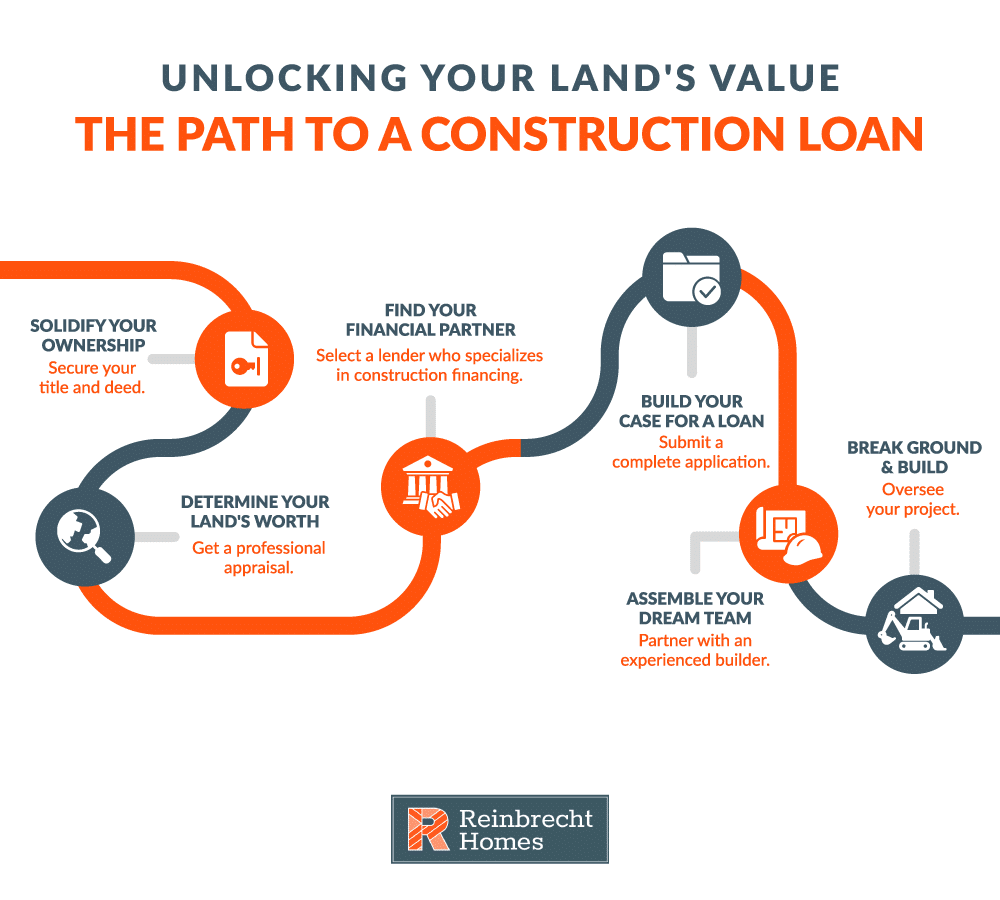

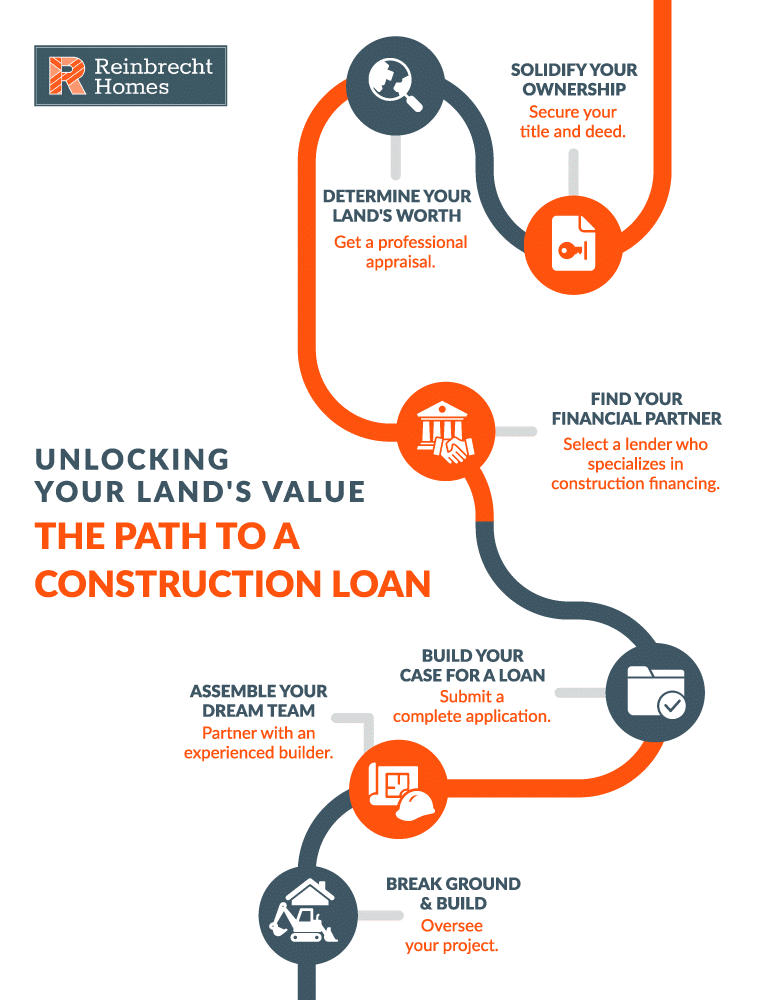

Step-by-Step Guide to Using Land as Collateral

Follow this clear, simple process to use your land as collateral for a construction loan:

1. Confirm Ownership and Gather Documents

Begin by ensuring your land title is clear and free from liens or disputes. Gather essential documents such as the deed, title, and any ownership records.

2. Obtain a Professional Appraisal

Hire a certified appraiser to evaluate your land’s market value. This report is crucial for establishing the equity you can use to support your loan.

3. Choose the Right Lender

Research lenders that specialize in construction loans, particularly those familiar with the market in which you’re building. Compare their terms, interest rates, and specific options for custom homes.

4. Prepare and Submit Your Loan Application

Compile your documentation—including the appraisal report, construction estimates, building plans, and proof of ownership. Submit your application with complete and accurate information to enhance your approval chances.

5. Assemble Your Homebuilding Team

Partner with experienced builders and advisors who understand local construction trends. Work with them to establish a clear draw schedule with your lender to ensure funds are released as work progresses.

6. Manage Construction and Stay Involved

Monitor your project closely with regular communication between you, your builder, and your lender. Promptly address any issues to keep your project on track both financially and schedule-wise.

How Reinbrecht Homes Simplifies Your Financing Journey

Reinbrecht Homes aims to make the home construction and financing process more accessible. Here’s how they contribute to the process:

Free Construction Loan Option

Reinbrecht Homes offers a free construction loan option, which can help eliminate some additional borrowing costs and streamline the financial process. This benefit allows you to focus on designing and building your home rather than worrying about extra financing fees.

Personalized, Hands-On Guidance

From gathering documentation to coordinating with lenders, the team at Reinbrecht Homes provides clear, step-by-step support. Their guidance ensures that every detail is managed with care and transparency.

Extensive Local Expertise

With decades of regional experience, Reinbrecht Homes is well-versed in local land use, zoning requirements, and construction nuances. Their expertise helps minimize unexpected challenges and keep your project moving smoothly.

FAQs About Using Land as Collateral for Construction Loans

Can Land Equity Fully Cover My Construction Loan?

In many cases, the equity in your land can cover a significant portion of the financing needs. Typically, lenders use the land equity to lower the required borrowing amount rather than cover the entire loan.

What Happens if My Land’s Value Changes During Construction?

Market fluctuations may affect the appraised value of your land. While short-term variations usually do not impact the approved loan, significant changes might require a new appraisal to assess the available equity.

Are There Special Loan Options for Custom or Semi-Custom Homes?

Yes, many lenders offer specialized loan programs for construction projects on custom or semi-custom homes. These options often include flexible draw schedules and terms tailored specifically to unique building projects.

From Land Equity to Your Front Door

Using land as collateral offers a practical approach to financing your dream home through construction loans. While leveraging your land’s equity can potentially reduce upfront costs and simplify the financing process, the specific benefits—such as lower down payments or smaller monthly repayments—will depend on factors like your land’s equity, your financial stability, and the lender’s requirements. With clear steps, practical tips, and the expert support of Reinbrecht Homes, you can confidently work towards creating a beautifully crafted living space.

Ready to take the next step? Contact Reinbrecht Homes today to schedule your consultation to schedule your consultation and start building your dream home.