Typically, a person building a home would expect to pay for the land, their architectural plans, a down payment, and interest payments during construction.

Not when you build with Reinbrecht Homes.

When you make the decision to build a home with us, many of these expenses are already included in the purchase price of your home, such as the land, as well as your architectural plans – when you choose one of our floor plans in one of our neighborhoods.

Still, life and other expenses don’t come to a halt when you make the decision to build a home. While your home is being built, you’ll likely still have a mortgage on your current property, or rent at a temporary location, storage fees, – and more – but these factors shouldn’t prevent you from being able to build a new home!

Instead, we want to make the home building process as simple and affordable as possible. We offer free construction financing up to $200,000 – not only making building your dream home a reality but providing the support to achieve that dream affordably.

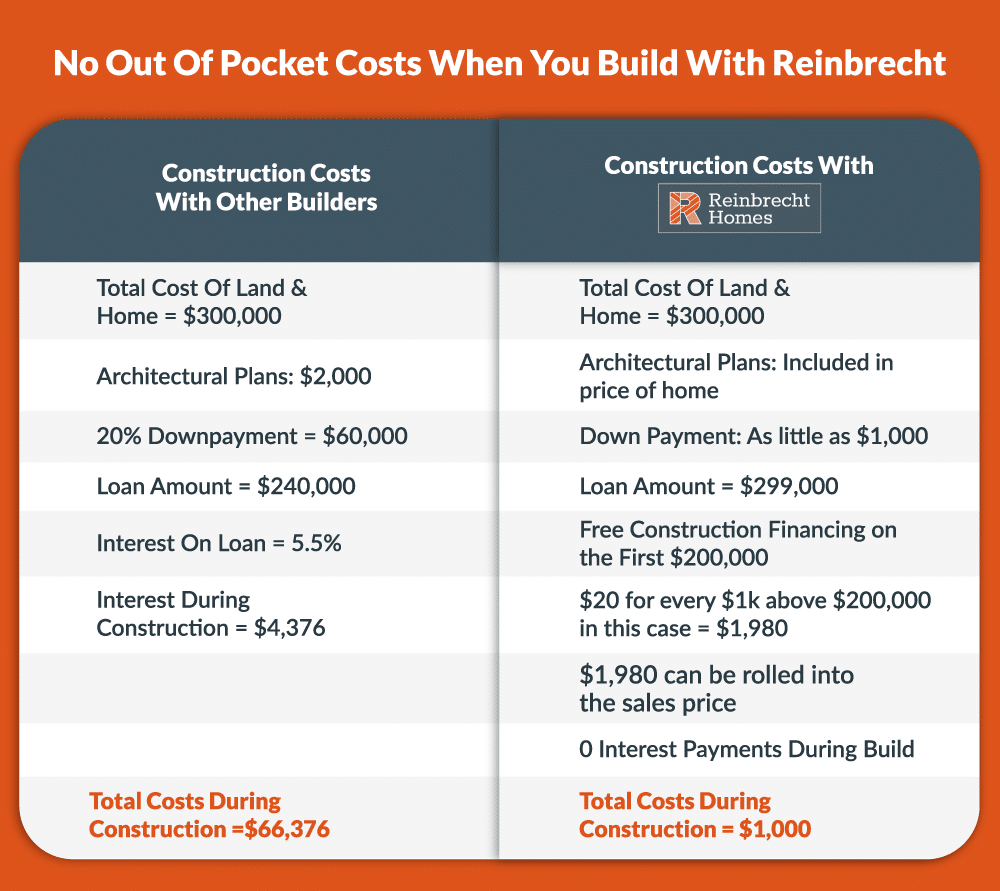

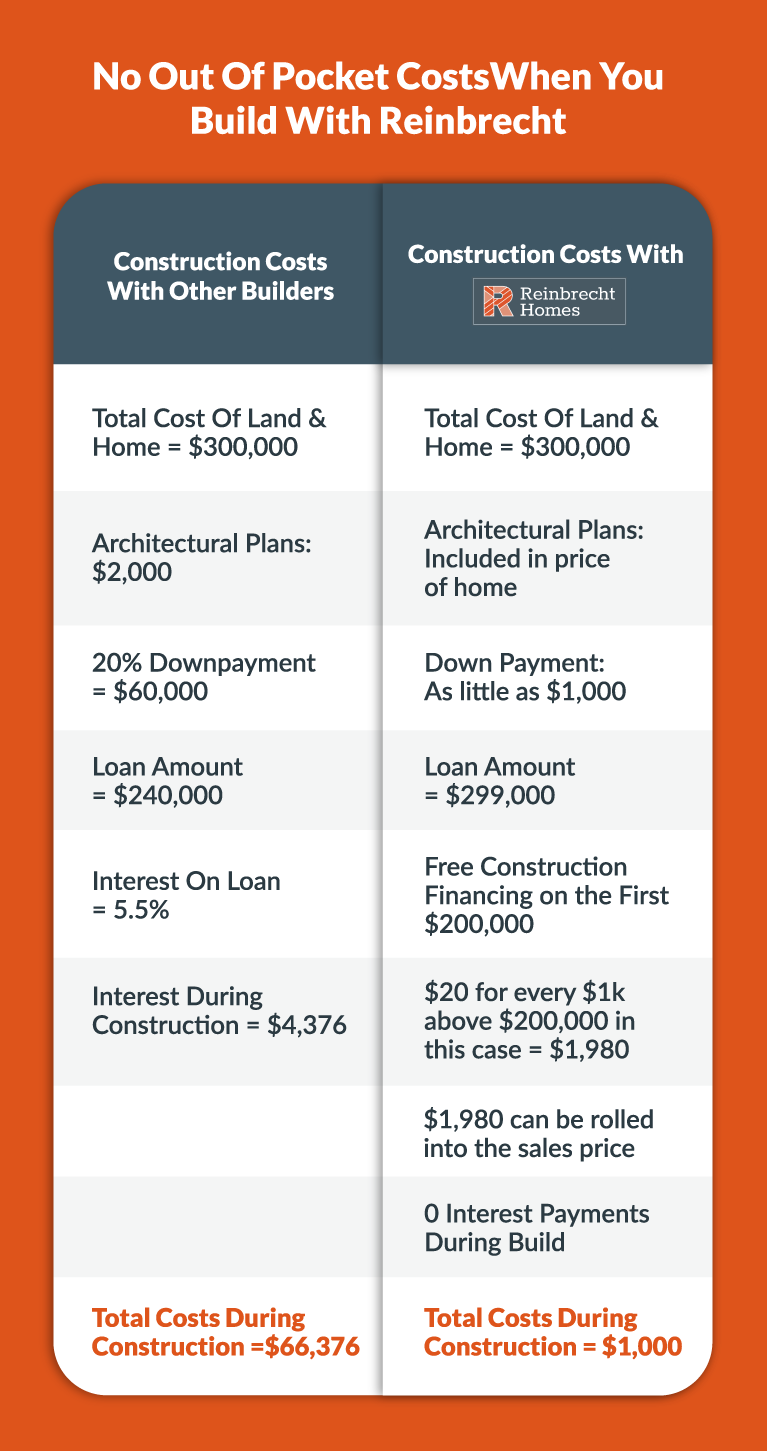

Here’s what to expect when building a home with Reinbrecht Homes, and what the process looks like for some other builders.

SOME OTHER BUILDERS

- Sign a contract

- Pay for land

- Down payment/deposit (based on land, sometimes as high as 20% is required)

- Architectural Plans (if not included)

- Interest-only payments during construction

– Interest Payments are based on the total amount borrowed/disbursed, not the total amount of the end loan.

Average build time: 6 to 8 months

Example:

Let’s assume the total cost for your land and home is $300,000.

This is the sale price.

You plan to make a down payment of $60,000 (20%).

So you’ll borrow $240,000 through a construction loan.

The bank is only going to charge interest on the amount of loan that is drawn during construction.

Let’s assume a current interest rate of 5.5%.

Sale Price: $300,000

Down Payment: $60,000

Loan Amount: $240,000

Interest Rate: 5.5%

ESTIMATED INTEREST PAYMENTS DURING CONSTRUCTION

Month 1: $110.00

Month 2: $275.00

Month 3: $418.00

Month 4: $605.00

Month 5: $869.00

Month 6: $999.00

Month 7: $1,100

Total Estimated Interest: $4,376.90

Keep in mind, this money doesn’t lower your principal balance, and you pay it the duration of the build until you close on the new home. Also if the build time takes longer than expected these interest payments will continue until the home is complete and your permanent financing is finalized.

Your out-of-pocket costs thus far:

- Architectural plans – average plans in Evansville region are $2,000

- Down payment – in this case, $60,000, if 20% of $300,000 total loan was required

- Total interest payments – $4,376

TOTAL DURING BUILD: $66,376

Here’s a snapshot of the homebuilding process with Reinbrecht Homes, using our free construction financing up to $200,000:

REINBRECHT HOMES

- Sign a contract

- Down payment as little as $1,000

- Free construction financing for the first $200,000

Included in sale price when buying in one of our neighborhoods

- Land

- Architectural plans

Average build time: 6 – 8 months

Here’s an example:

The sale price for your custom build is still $300,000.

You can put down as little as $1,000.

You borrow: $299,0000

Reinbrecht Homes provides free construction financing during the build, up to 200,000. Any amount financed over $200,000 is simply assessed a flat fee of $20 per $1,000 financed, and this cost can be rolled into the purchase price of the home.

In this example, you’d pay $20 per thousand on $99,000, or $1,980, which does not need to be out-of-pocket but can be rolled into the purchase price. There are zero interest payments during the build.

Your out-of-pocket costs thus far:

- Down Payment – in this case, $1,000

TOTAL DURING BUILD: $1,000

The bank will set a closing date after the anticipated completion of your home’s construction. It isn’t until closing that you will be required to pay down payments, closing costs and other fees for your permanent mortgage.

The beauty of this process is that you can keep all the money during the build in your own accounts which might even be earning interest. Additionally, you are not throwing away interest-only payments during the build. The combination of these two factors can really add up during the build, which can hopefully set you and your family up for a great start in your new home.

This process can also be done when building on your own land with your custom floor plans. However, you will have the expense of floor plans to add as out-of-pocket expenses, but the financing with no-interest payments can still be utilized.

We can even buy the land or property for you which will keep you from incurring more out of pocket expense until the time the home is completed.