Don’t make your home buying experience more stressful than it needs to be.

Before you meet with your home builder, it’s wise to know exactly what you can afford and what you’ve been approved for. Having a full understanding of these budgetary constraints streamlines the entire home buying process.

Essentially, before you spend weeks picking out floor plans, furniture, and accessories, you should make sure you can afford the payment for the home.

You were pre-approved for a certain amount, but that doesn’t mean you should spend it all.

Just because you can doesn’t mean you need to.

Why Pre-Approval Shouldn’t Dictate What You Spend:

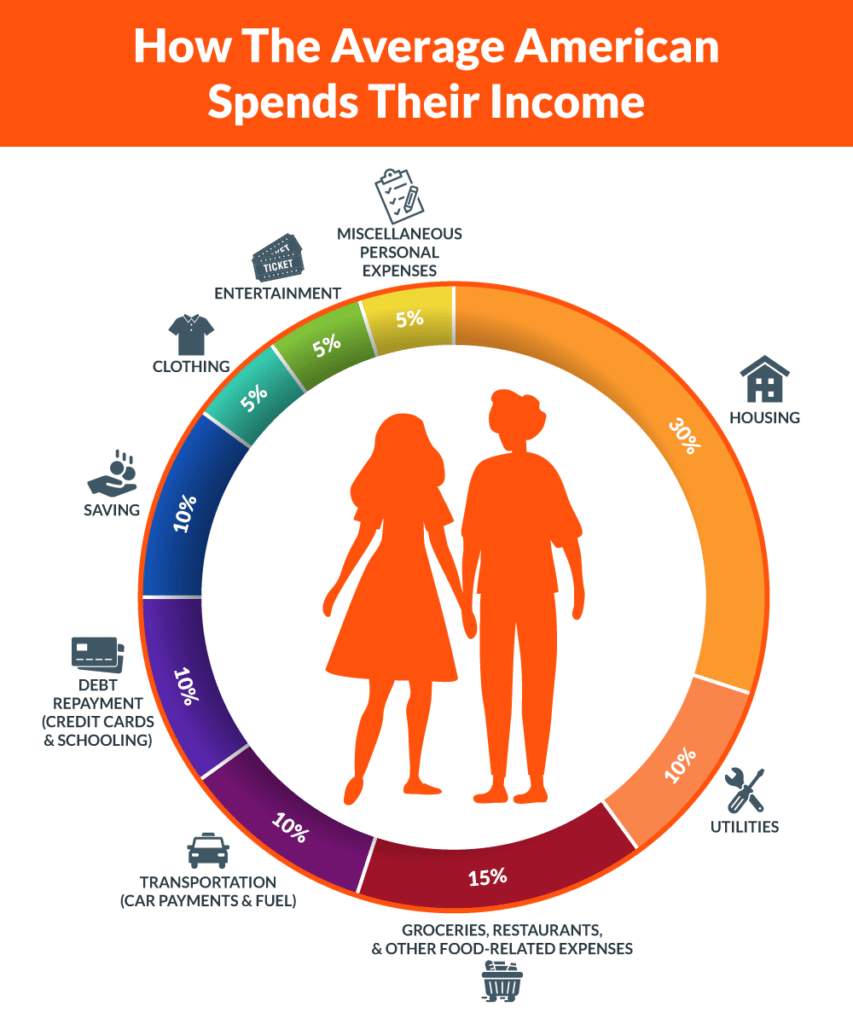

The average American spends close to 30% of their income on housing.

However, the pre-approval process is not restricted to a certain percentage and isn’t concerned with your other monthly expenses. You could potentially be pre-approved for a home that would cost you upwards of 50% of your income.

For example: You could go to a bank right now and get pre-approved for $350,000 to build a home, which would result in a monthly payment of $1,800. However, based on your current set of bills and spending habits, you may only be able to afford $1,400.

Consider these extra expenses before committing to a price range:

(The percentage reflects the average amount of annual salary typically used on these items)

- 10% – Utilities

- 15% – Groceries, restaurants, & other food-related expenses

- 10% – Transportation (car payments & fuel)

- 10% – Debt repayment (credit cards & schooling)

- 10% – Saving

- 5% – Clothing

- 5% – Entertainment

- 5% – Miscellaneous personal expenses

Remember the other associated fees!

- Property taxes

- Insurance

- Maintenance

Should I Tell My Home Builder My Budget?

Yes. It’s very important that your home builder knows your budget. Builders don’t change the price of the home you’re interested in just because you’ve been pre-approved for more.

Reinbrecht offers pre-priced floor plans, which means we don’t change the price based on budget or pre-approvals.

For example: If you have a budget of $250,000, we’re going to steer you toward floor plans within the $200K – $220K price range. That way you have some budgetary wiggle room for other things like cabinet upgrades or granite countertops.

What if I’m designing a custom plan? Won’t you just raise the price to meet my budget?

No, we have no interest in raising the price to meet a budget.

This would simply make it difficult for us (or any builder) to compete in the market, as it would technically make us overpriced compared to competitors.

Why Should I Tell a Builder My Budget?

1.) To save yourself money

Builders actually need to refer to your budget as the floor plans are drawn.

We have a pretty solid idea about what most homes will cost before we build them, therefore we can let you know what style and size of home you can afford before you pay to have a plan drawn.

Having a custom plan drawn can cost you between $1,500 – $2,500 (or even more) depending on how elaborate it is.

You don’t want to pay the fee to have the plans drawn only to find out that you can’t afford to build the home.

Then you’ve either wasted your money on the initial plans, or you’ve paid extra to get them altered. We witness this scenario frequently.

2.) To save yourself time

If you don’t share your budget with a builder, you may end up wasting a lot of your own time.

In order for us to provide precise home quotes, we take the time upfront to discuss all the specific finishes and features you’d like included in the home.

You don’t want to waste multiple meetings of sifting through options, just to get a quote back that’s over your budget.

If you provide your realistic budget upfront, we can let you know that you may be overshooting your budget before we ever get started.

We’ve seen plenty of cases when we put quotes together for potential clients and the price may be $50,000 to $100,000 over their budget.

Save yourself some extra time by figuring out what you’re willing to spend right out of the gate.

How to Prepare for Our First Meeting:

- Get pre-approved to find out what you can spend

- Take a good look at your overall finances and budget to decide what you want to spend

How Do I Get Pre-Approved?

Reinbrecht partners with several local banks to facilitate the best home building and financing experience possible.

There’s a lot of financial decisions to make before understanding what percentage of your salary should be dedicated to buying a new home.

But once you figure it out, let’s meet!