Buying your first home is an exciting milestone, but navigating the world of mortgages can feel overwhelming. Suddenly, you’re faced with an alphabet soup of options—FHA, VA, USDA—and terms like “fixed-rate” or “ARM.” Choosing the right loan is critical, as it will impact your monthly payments and financial health for years to come.

This guide is designed to cut through the confusion. We’ll break down the essential mortgage types, from government-backed programs to conventional loans, to help you understand which one aligns with your financial goals. With the right knowledge—and a supportive partner like Reinbrecht Homes—you can navigate your financing options with confidence and make a smart, stress-free investment in your future.

Understanding the Basics of Mortgages

What Is a Mortgage?

A mortgage is a financial agreement that allows you to borrow money for buying or building a home. Essentially, it’s a loan where the property serves as collateral. As a borrower, you repay what you owe through monthly installments covering both principal and interest—usually over 15 to 30 years. However, if you fail to make payments, the lender can take ownership of the property through a foreclosure process.

Understanding how mortgages work is crucial because they affect your monthly budget and the total cost of homeownership. For first-time buyers, familiarizing yourself with different loan types can help you select an option that aligns with your financial goals.

Financing a New Build vs. an Existing Home

While a traditional mortgage is used for an existing property, building a home often requires a two-step financing process. This typically starts with a construction loan, a short-term loan that covers building costs and often features interest-only payments while your home is under construction.

Once building is complete, this loan is converted into a standard, long-term mortgage. Understanding this distinction early is key to keeping your new home construction on schedule and on budget.

Top Mortgage Options for First-Time Homebuyers

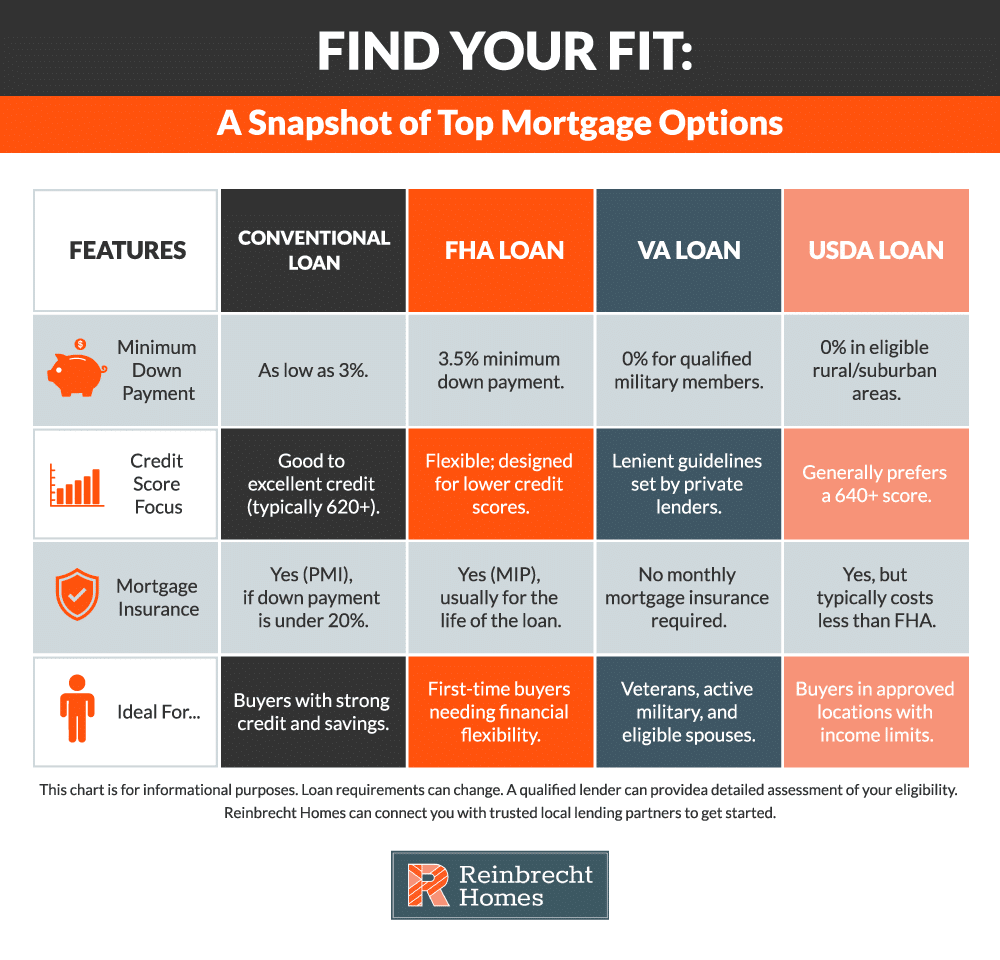

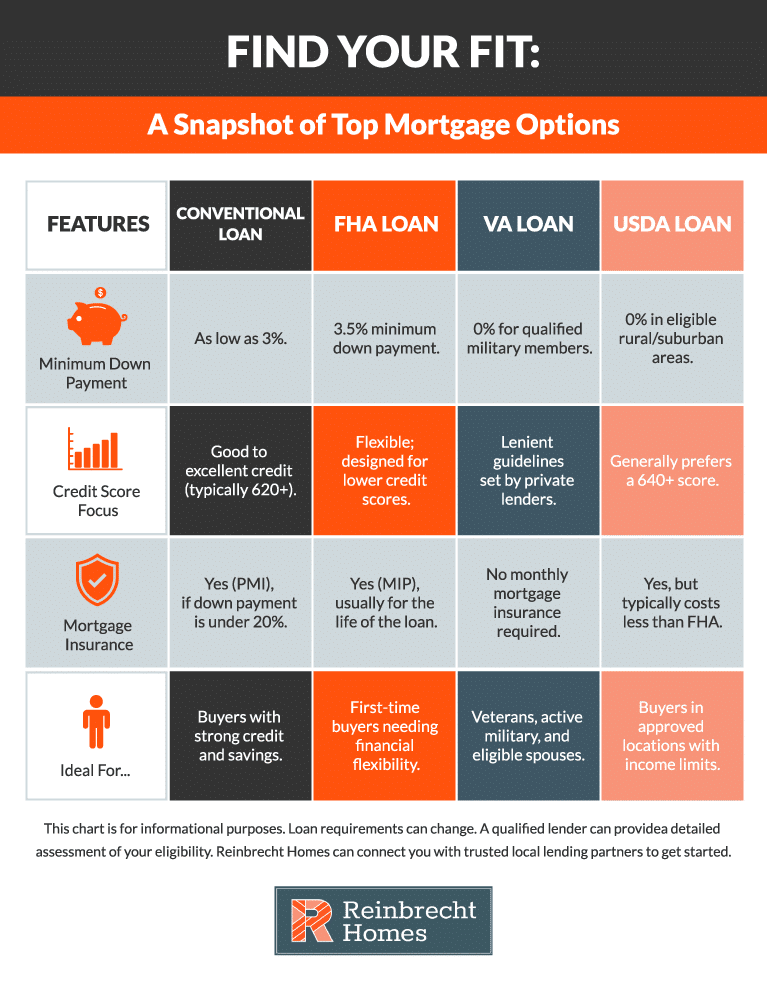

For first-time homebuyers, examining your loan options is essential. Each type has unique benefits, drawbacks, and qualification standards. Below are some of the most common home loans to consider:

Fixed-Rate Mortgages

A fixed-rate mortgage locks in your interest rate over the life of the loan, typically for 15 or 30 years.

- Predictable Payments: You’ll always know your monthly principal and interest.

- Great for Long-Term Plans: If you plan to stay put, the consistent rate adds stability.

- Potential Trade-Offs: Your initial rate may be higher than an adjustable-rate mortgage (ARM).

Adjustable-Rate Mortgages (ARMs)

An adjustable-rate mortgage features an introductory fixed rate for a certain period, after which the rate fluctuates based on market conditions.

- Lower Starting Rates: Often beneficial for saving money in the initial years.

- Flexibility: Ideal if you plan to move or refinance before the rate adjusts.

- Risk Factor: Future rates may increase, raising your monthly payment.

FHA Loans

FHA loans are backed by the Federal Housing Administration. For more details on their background and purpose, see the Federal Housing Administration (FHA).

- Low Down Payment: As little as 3.5% can get you started.

- Lenient Credit Requirements: Designed for buyers with limited savings or lower credit.

- Extra Costs: Requires both upfront and annual mortgage insurance premiums.

VA Loans

VA loans are overseen by the U.S. Department of Veterans Affairs.

- No Down Payment: Significantly reduces upfront expenses.

- No Monthly Mortgage Insurance: Lowers your recurring costs.

- Eligibility: Borrowers must provide proof of military service and meet certain property criteria.

USDA Loans

Offered through the U.S. Department of Agriculture, USDA Single-Family Housing Programs are intended for rural and some suburban areas.

- Zero Down: Often available with no down payment for qualified buyers.

- Geographic Restrictions: Only applicable in specific regions.

- Income Caps: Must meet local income limitations for eligibility.

Conventional Loans

Conventional loan options have no government backing and are issued through private lenders.

- Flexible Terms: Choose your loan duration and features.

- Avoiding Insurance Costs: Put 20% down or more to skip private mortgage insurance.

- Best for Good Credit: Higher scores and stable income often lead to favorable rates.

Interest-Only and Balloon Loans

Interest-only and balloon mortgages can keep initial payments lower but involve higher risk.

- Interest-Only: Early payments pay interest alone, leading to larger payments later.

- Balloon Loans: Smaller payments for a set term, then a lump-sum payoff.

- Risks: These loans can be practical if you anticipate a substantial financial change before the bulk of the payment is due.

Your Step-by-Step Guide to Getting Approved

Navigating the mortgage journey can feel daunting, but a few proactive measures can make it a smooth and successful experience. By focusing on the right factors at the right time, you can confidently secure financing for your new home.

1. Assess Your Financial Health and Build Your Savings

Before anything else, get a clear picture of your finances. Review your credit report for inaccuracies and work on strengthening your score by paying down debt. Lenders will also evaluate your debt-to-income ratio (DTI)—what you owe versus what you earn—so lowering it can significantly improve your loan options.

At the same time, build up your savings. Beyond your down payment, you’ll need funds for closing costs, moving expenses, and an emergency fund. Budget for future recurring costs like property taxes and homeowners insurance, which add to your monthly housing expense. If you’re building a new home, plan for construction loan interest and potential overruns.

2. Secure Pre-Approval Before You Search

Once your finances are in order, get pre-approved by a lender. A pre-approval letter defines your realistic price range and demonstrates to sellers and builders like Reinbrecht Homes that you are a serious, qualified buyer.

3. Evaluate Loan Options Based on Your Goals

With a budget in hand, compare different mortgage types to find the right fit. Your decision should align with your future plans:

- Fixed vs. Adjustable Rate: If you plan to stay in the home long-term, a fixed-rate mortgage offers predictable payments and stability. If you might move or refinance in a few years, an adjustable-rate mortgage (ARM) could offer a lower initial rate.

- Loan Term Length: A 30-year term will give you lower monthly payments, while a 15-year term helps you build equity faster and pay significantly less in total interest.

4. Gather Documentation and Finalize Your Application

Lenders require extensive documentation to verify your financial standing. Start gathering key records like pay stubs, W-2s, tax returns, and bank statements. For a custom build, you will also need project estimates and construction contracts. Once you have your paperwork organized, complete your loan application accurately and respond to any lender requests promptly to keep the process moving.

5. Prepare for Closing and the Final Details

The final stage involves several crucial steps. You will need to arrange for a home appraisal and inspection, secure homeowners insurance, and lock in your interest rate. Review your closing disclosure carefully and ensure your funds are ready for the closing day. By organizing your paperwork and staying on top of these final details, you’ll be ready to cross the finish line and get the keys to your new home.

The Role of Reinbrecht Homes in Supporting Mortgage Decisions

At Reinbrecht Homes, we recognize how pivotal financing is to achieving your dream home. Our team strives to make the mortgage process transparent and straightforward, whether you’re constructing a custom home, choosing a semi-custom design, or moving into one of our available homes.

Expert Guidance and Specialized Financing

We collaborate with knowledgeable lending professionals to navigate construction loans, including our free construction loan for qualified buyers. This offering can help ease initial costs, giving you more flexibility as we build.

Transparency Every Step of the Way

From required documents to important deadlines, we keep you informed so you can manage your finances without surprises. Clear communication helps you focus on the excitement of designing your new home.

Real-Time Updates with Buildertrend

During construction, you’ll have access to Buildertrend for detailed updates on progress. Track timelines and see budget information, making it easier to plan each phase.

Tailored Support for Custom and Semi-Custom Homes

Securing a construction loan is different from financing a pre-built home. Our experience with phased disbursements, inspections, and permanent loan conversions helps ensure a smooth transition from groundbreaking to move-in.

Local Knowledge and Expertise

After more than 30 years in Southern Indiana and Eastern Illinois, we understand local regulations, market nuances, and neighborhood trends. This insight helps streamline the lending process for your specific region.

By choosing Reinbrecht, you gain a builder who’s as invested in your home’s financing as in its construction. Our guidance, complimentary construction loan option, and transparency help make your journey more stress-free.

Common Mortgage Questions and Concerns

Many first-time buyers wonder about loan affordability, timelines, and credit issues. Below are a few frequently asked questions to help clarify the mortgage process:

Q: How much home can I afford?

A: A general rule is to keep total housing expenses between 25% and 30% of your monthly gross income. For a precise figure, a lender’s pre-approval can give you a clear budget range based on your unique finances.

Q: What’s the difference between a construction loan and a traditional mortgage?

A: Construction loans fund the building phase, often requiring interest-only payments until completion. Afterward, the loan can convert into or be refinanced as a traditional mortgage. Traditional mortgages finance existing homes or move-in-ready constructions.

Q: Are there special loans available for custom homes?

A: Yes. Construction loans are specifically designed to cover building expenses incrementally, and certain government-backed programs (like USDA or FHA) may apply, depending on location and your financial details.

Q: Do I need mortgage insurance?

A: If you put down less than 20% on a conventional loan, you’ll typically need private mortgage insurance. FHA loans also charge annual premiums. VA loans don’t require monthly mortgage insurance, making them a good option for those who qualify.

Q: What if I have a low credit score?

A: Buyers with lower credit scores may still qualify for loans like FHA. Some private lenders also offer non-prime loans. Improving your credit—through consistent debt payoff—can help you secure more favorable terms.

Q: Is a larger down payment always better?

A: Putting more money down reduces your loan amount and monthly payments. However, you don’t want to drain your savings to the point where you’re unprepared for emergencies. Aim for a balanced approach that aligns with your long-term goals.

Q: How long does the loan approval process take?

A: It can take several weeks, depending on your lender and financial complexity. Being prompt with documentation and having your finances in order helps move approval along more quickly.

Navigating Your Mortgage Journey with Confidence

Understanding your mortgage options—from fixed or adjustable-rate mortgages to government-supported FHA, VA, and USDA loans—is vital for a smooth homeownership experience. Choosing the right financing paves the way for stability and confidence, especially if you’re embarking on a custom or semi-custom build.

At Reinbrecht Homes, we believe first-time buyers deserve transparency, flexibility, and expert support. Our goal is to simplify financing so you can focus on turning your dream home into reality—without unnecessary obstacles.

Ready to take the next step? Contact Reinbrecht Homes today to explore your financing options and begin crafting a future you can be proud of.