Before diving into home building, you’ll want to make sure you’re prepared for the process and everything that comes after.

Here, we’re breaking down everything you need to know about new home taxes:

Paying Property Taxes on Your New Home

Sometimes new homeowners fail to recognize the financial impact that property taxes will have on their budget. So it’s wise to understand exactly how many hundreds (or thousands) of dollars you’ll be paying on top of the price of your home.

Property taxes are a primary source of funding for units of local governments. They’re used to pay for a variety of local services like police and fire departments, maintenance of local infrastructure, and the operations of local government.

Property taxes are assessed each year and due the following year. So when you receive your property tax bill, it is for the assessed value of your home in the previous year. Depending on what time of year your new home is completed, you may not pay property taxes on the value of the home for a year (or longer).

So How Much Should I Pay for Property Taxes?

It varies on location, but Dave Ramsey recommends that your property taxes (in accompaniment with your mortgage payment) shouldn’t exceed 25% of your annual salary. While this isn’t necessarily possible for low-income couples building their first home, it’s something to keep in mind!

The Property Tax Assessment Process

Properties in Indiana are valued using mass appraisal techniques. With mass appraisal, your property is looked at in conjunction with other properties in the area. Age, grade, and condition are all factors that your local assessor will consider when they evaluate your property.

Each year, a process called annual adjustment takes place. In this process, property sales data is used to determine if the value of the properties in the area should change to match the market value of the recent sales of properties.

You will receive a notice of your property’s value through a Form 11 (the notice of assessment from your county assessor) or you can find it on your TS-1 tax comparison statement (your tax bill).

What If I Inherit the Property. Do I Still Pay On It?

Unfortunately, yes. Even if you inherit a property (like farmland), you’ll still be responsible for footing the bill.

Deductions

To minimize the amount of taxes you pay on your new home, you can apply for property tax deductions like mortgage deductions and homestead deductions.

Mortgage deductions

In Indiana, you could qualify for a mortgage deduction on your property taxes if you’re buying a property on a recorded mortgage or recorded contract. This deduction is whichever is less: $3,000 or half of the property’s assessed value. You can obtain a mortgage deduction on more than one property, but it cannot exceed the maximum of $3,000 on all properties. You can find the mortgage deduction application here.

Homestead deductions

Ready for some numbers? Okay, here we go.

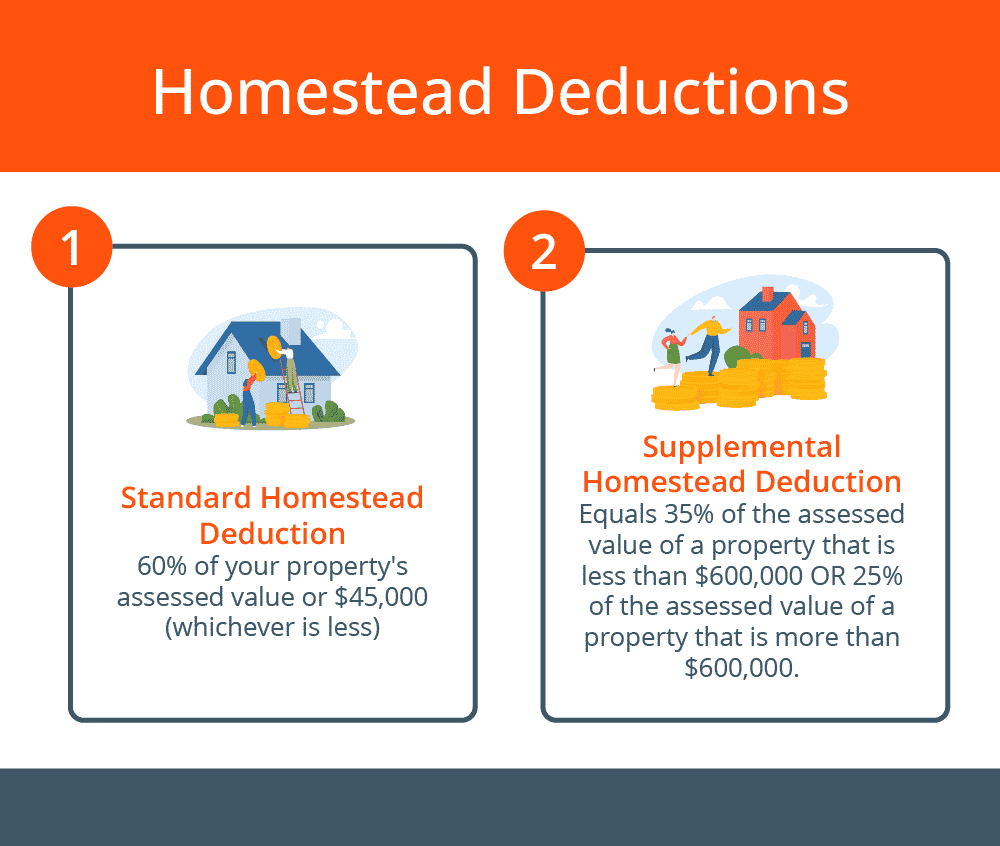

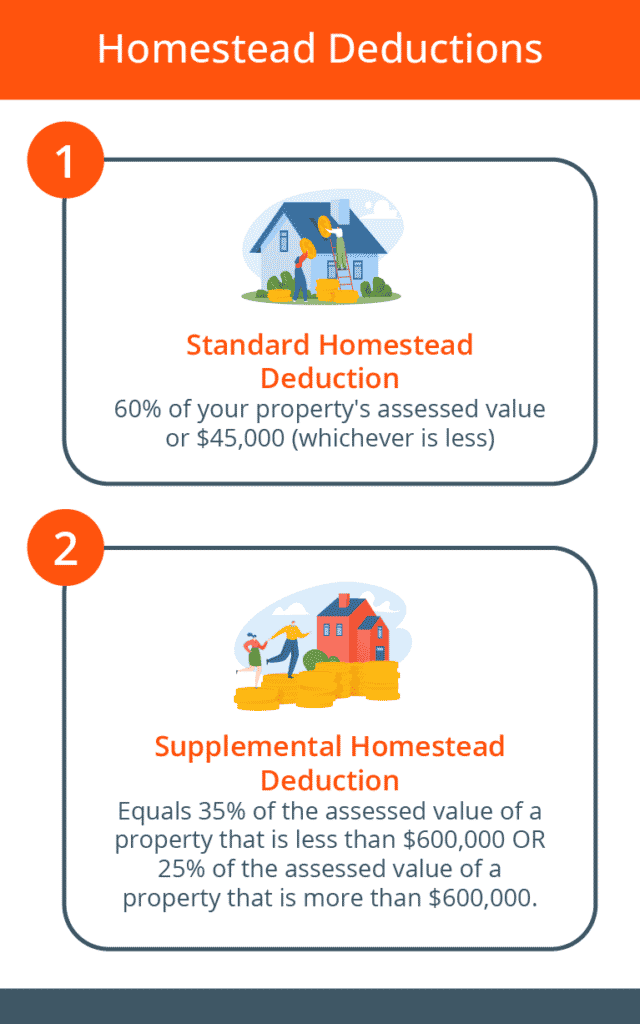

If you own a home that serves as your primary place of residence, your home and up to one acre of land could qualify for homestead deductions on your property taxes. There are two types of homestead deductions:

- The standard homestead deduction is either 60% of your property’s assessed value or a maximum of $45,000 (whichever is less).

- The supplemental homestead deduction is based on the value of your property. It equals 35% of the assessed value of a property that is less than $600,000 OR 25% of the assessed value of a property that is more than $600,000.

Remember: If you make a change to your title, you’ll need to file for the homestead deductions again. And, if you ever decide to sell your home, you’ll need to have the deductions removed.

You can find the homestead deduction applications here.

What Happens When I Pay Off My House?

Even though you’ve paid off your house payments and are basking in the joy of being debt-free, you’ll still need to keep up on your property taxes. There’s a difference though. You won’t be writing these checks to your bank anymore. You’ll be paying your local government.

Something to note: If you have been taking advantage of mortgage deductions on your property taxes, you will no longer be eligible for those deductions once your mortgage is paid off.

Expert Tip: If you do pay off your home mortgage there is a way to still receive the mortgage deduction! You can take out a line of credit on the home and this will still qualify for the deduction and you do not even have to carry a balance on the line in order to receive the deduction. However, there will be a small fee from your lending institution to keep the line of credit open, but the deduction should more than offset the fee.

With Reinbrecht Homes, no tax is added to the price of the home.

We offer straight costs so that the buyer knows exactly how much their new home is going to cost and what goes into the cost. If your contract is for $255,800, that’s the amount you pay with zero taxes added on.

Learn more about our building process in our in-depth home guide.